Who asked the clients?

- Mark Geoghegan

- Dec 15, 2025

- 5 min read

It's as predictable as Old Faithful, as inevitable as the fresh stream of saliva dribbling from the chops of one of Pavlov’s much maligned canine pets when the dinner bell is rung and as reliable as the knee that acquiescently extends after a sharp prod from the physician’s mallet.

One automatic reaction that can be guaranteed from any industry CEO I speak to is this:

If I ask them what the most valuable part of their business is they will say without fail:

“The biggest asset we have is our people”

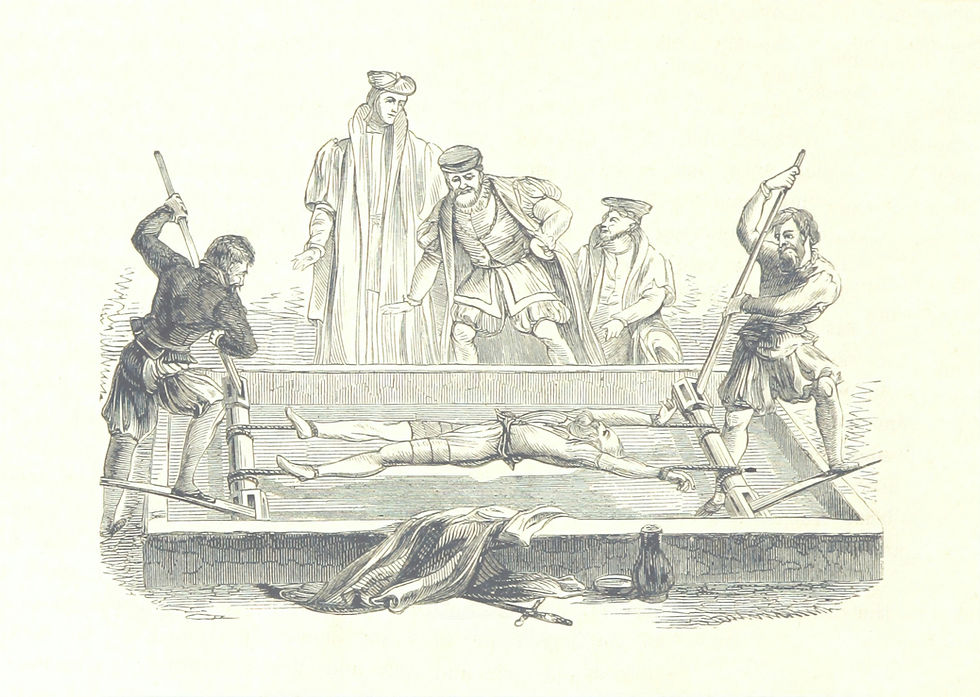

They are all wrong. People are people, they are not assets. They cannot be bought and sold and they are free to come and go as they wish. The abhorrent practice of slavery ended in the 19th Century.

Yet the principal employers in our business still often treat people as if they were property.

Pick up the insurance press and the pages will be dominated by “poaching” disputes clogging up courthouses across continents.

Employee A moves to Employer B for a better job, with better prospects and better pay. Others at Firm A do the same. Employer A sues Employee A and Employer B, alleging some form of conspiracy and heinous theft of trade secrets. The thing drags on but is usually settled out of court before anything too damaging is revealed.

But sometimes it goes all the way and mud is slung far and wide. I have been covering these for decades.

Laptops in lakes, innumerable memory sticks, meetings in Hotel lobbies shakily filmed by private investigators, mass defections allegedly fomented at football matches, writs served to departing executives while lounging by the pool on Caribbean holidays… and that really bitter one with all the cringeworthy WhatsApps.

These and countless others have all provided bar-room entertainment for the chattering insurance classes for decades.

And it just keeps coming. There is precious little else to read about at present. It is a wholly unedifying and thoroughly depressing spectacle that is doing the industry very few favours.

Imagine an employer making it very clear to every prospective job candidate that if they ever left to work at a competitor, they would be personally sued, accused of stealing trade secrets, dragged into interminable depositions and cross-examinations and have their character and good name openly questioned.

That employer probably wouldn’t employ many people and rightly wouldn’t have much business. Yet this is what happens every day in our sector. It is so much part of the playbook that it is probably taught at insurance-focussed MBA courses.

At first it looks like it’s all part of some big, elaborate game and is nothing to be taken too personally.

Yet the same CEOs who automatically fire off writs whenever a senior manager leaves, fetishistically tell me how much they love their staff and recount how they are concocting ever more elaborate benefit and support packages to be able to cosset, nurture and retain them in a hyper-competitive market.

Who wouldn’t want to be among these pampered hordes, adored and worshipped by their bosses?

But we should judge the industry on its actions rather than its words.

And in practice its actions are those of the worst coercive, controlling partners.

They profess their eternal, undying love, but if you ever try to leave, they will threaten to kill you.

How selfish of you not to realise that since they just can’t live without you, your leaving would effectively be murder!

So, it’s not really a game. What sort of toxic, selfish love is this?

You can check in whenever you like, but you can never leave. It’s nothing personal, but it could personally ruin you.

Senior management must also be deluded if it feels that ritualising court-sanctioned humiliation of departing staff somehow encourages the other incumbents to stay. I would say it just encourages them to leave, carefully.

Once you reveal to people that you are capable of this kind of behaviour, surely they are much more likely to jump ship at the first possible opportunity than be cowed into submission?

Now let’s stop all this and substitute the word employee for client.

Has anyone ever heard of a broker suing a former client for switching to another intermediary? Of course not!

When a broker loses an account, they don’t blame the customer, they rush to find out why they left. Was it price? Was it coverage? Was it service? What can we learn from this? What can we do better next time? Will you let us back in to quote next year?

Customers win as the industry strives to serve them better.

Imagine how clients feel when they read about these cases. A sector that feels it owns its staff and often, in private, talks about how it ‘owns’ the customer, doesn’t seem a very nice one to deal with, does it?

And quite apart from the terrible image we are projecting to the people who pay for our services, there are practical concerns.

A few years ago I bumped into a broker friend in the market and asked how things were going.

He said that they were going really badly. I was surprised because I thought his market was in pretty good shape.

Then he told me that, although everything was notionally fine, all four of his main lead underwriters were out of action because they were on bouts of six-month gardening leave at the same time.

Each had been simultaneously lured to a new employer and none were currently available to work.

The result was that, while straightforward renewals we just about okay, difficult renewals were a nightmare and new business production had plummeted to zero because no-one was available to quote.

Explain that to the customer!

We need a re-set. We have an industry that is very good at collaborating and competing. We have common data records, robust rules and regulations and registered standard contract wordings and clauses.

Perhaps it is time for market-standard employment contract wordings?

LMA Employment Contract 101, anyone?

Notice periods and restrictive covenants could be standardised, or better for customers, eliminated altogether, whilst very clear definitions could be laid down, governing what conduct is or is not acceptable by employees about to move from one job to another, and vice-versa for their employers.

There really are very few transferable trade secrets in insurance. Proprietary models perhaps, but everyone has their own view of risk and everyone has their own proprietary models. Even if an employee did somehow manage to steal one, and their new employer had unwisely sanctioned this theft, upon reflection the new company would probably decline to use it, saying that it preferred its own!

What companies don’t have is longstanding, trusted relationships. Only the humans they employ have those.

So let’s remember to treat all humans so well that they will never think of leaving. They will appreciate it, and our customers will too. The only losers will be employment lawyers.

Comments