The ten most expensive words in English

- Mark Geoghegan

- Jan 17, 2020

- 3 min read

Why are hard casualty markets no fun?

Easy, if they were fun, they wouldn’t be hard markets.

Hard casualty markets come about when underwriters are not just scared, they are terrified.

Their confidence is shattered. Everything they thought they knew has been shown to be a lie.

Now the only thing they know is that they know nothing.

It is like a decades-long happily married person finding that their spouse has been cheating on them since their wedding night. With their best friend.

Suddenly they have to re-evaluate everything. The floor has caved in.

In fact the entire edifice of their confidence has been demolished and it needs rebuilding block by block. But before that can happen a new floor needs to be found on which to begin to re-cement solid foundations.

Right now we are Alice falling infinitely down the rabbit hole.

After years of knowing exactly the price of everything and knowing they were charging enough to cover claims, brokerage, a rainy day IBNR loading with extra reserving cream, a limbo-like reinsurance buy-down, a generous profit and a deposit on a yacht for themselves, one day underwriters wake up questioning everything.

The price is wrong, the claims are rampaging out of control, the IBNR is voodoo, the fat was creamed off years ago, the down and dirty cheap reinsurance is in run-off - and dispute, the profit is a loss and the yacht deposit is non-refundable.

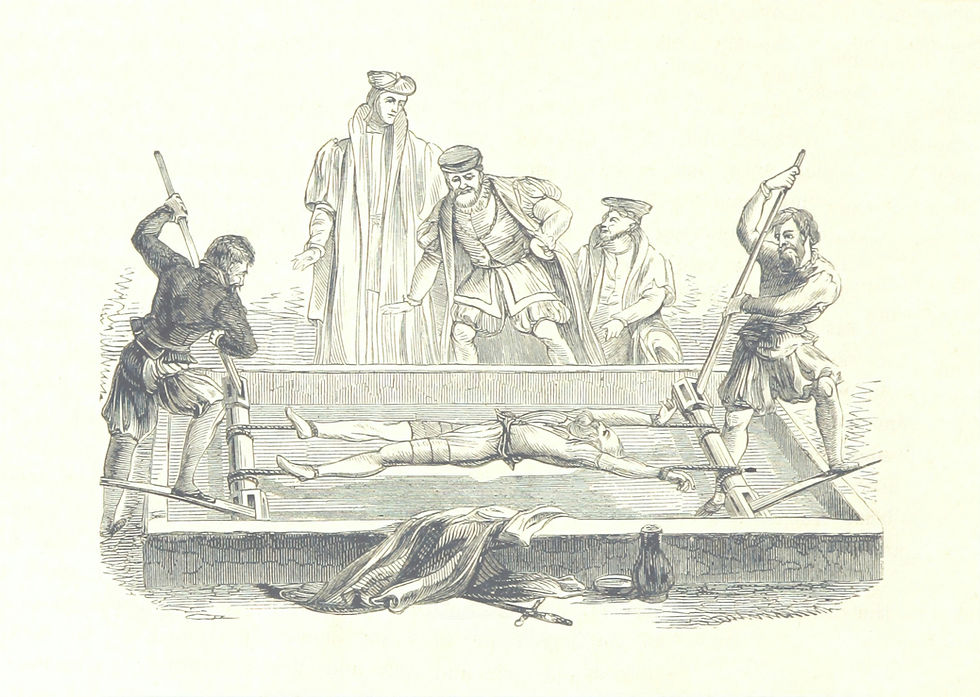

A terrifying blank cheque

The Insurers will indemnify the Insured against its legal liabilities.

In a proper hard market these ten words seem like the most expensive in the English language. They sound stupid – they are a blank cheque waved seductively in the faces of insatiable plaintiff lawyers.

They are all-embracing. They are terrifying.

Hard markets are no fun because of those ten words.

Legal liabilities can mean anything a jury wants them to mean.

In a proper hard market, even after quoting double the price, slapping on exclusions and quadrupling the deductible, underwriters almost die of shock when they get a firm order.

“My God, if they want to buy, I must have got it wrong again!” their queasy and fragile psyche screams.

A reacquaintance with something solid

For confidence to return the fall must end. For the dizzying descent to cease the earth must first be impacted.

This kills some and knocks others out cold. But for others who are better cushioned it is a reassuring reacquaintance with something solid.

From here a new trend starts to form. Bruised and broken bones can heal. After new capital is poured it can eventually solidify into a robust substructure.

Then the next market softening can be painstakingly constructed.

The longer the softening the bigger, more luxurious and elaborate the

building. Today’s market is the product of one of the longest, most benign and most prosperous ages in insurance history.

This is not just a nice house, this is a fairy-tale castle confected in the clouds.

The fall will therefore be more painful and psychologically traumatic.

Cinderella is going to divorce her no-good cheating handsome prince and beg her step mother to let her go back to mopping floors.

And then she is going to sever an artery in her foot when that stupid glass slipper shatters on the hard flagstones with a grinding crunch.

Her subsequent limp will be a permanent reminder that only a fool believes in happy endings.

Hard markets are no fun. They can only be appreciated fondly, years after the fact from the warmth and shelter of the new insurance edifice.

Then a plump and satisfied old underwriter can sit in the construction’s comfortable and tastefully-decorated lounge after a good dinner and recite these wise words into a cognac glass:

“Looking back, this was the best and most profitable period of my career.

But it sure as hell didn’t feel like it at the time”

Listen to my podcast about the beginnings of an epic hard E&S market here

Comments