The grow-your-own liability crisis

- Mark Geoghegan

- Jan 10, 2020

- 4 min read

Updated: Jan 11, 2020

Here’s a thought.

Is the social inflation that is now bleeding red ink into US casualty numbers and scaring investors really our own fault?

Were the eggs that hatched into the chicks that became the chickens that eventually came home to roost actually laid years ago by claims handlers in the insurance industry?

I am talking about a 1930s-style decade-long appeasement that only prolongs the inevitable bellicose confrontation that is to follow.

And when it does it only makes the reckoning worse when it finally does arrive.

Are we the weak victims of a long-term parasitical blackmail, paying up time after time until we are finally bled dry?

What’s this about?

Chickens, war and blackmail aside, I am talking about the practice of paying plaintiff lawyers to go away regardless of whether a claim is valid or not.

When pricing is adequate and profits are there to be made, many will shrug and say that this is just the cost of doing business.

We are there to defend clients, but we are also there to make problems go away quickly.

And if we pay off a few chancers then the clients are happy because they don’t have to have to deal with the negative publicity of having their names dragged through the courts.

We can also kid ourselves that we are saving defence costs by not defending.

And as long as we are all making money then everyone is happy.

But by not defending defendable claims we are storing up a problem for the future. And this is a debt that compounds and balloons unforgivingly, like the numbers in a loan shark’s little black book.

Failing to set precedents in our favour becomes a false economy that can become very expensive in the long run.

If instead of spending $40,000 kicking out a frivolous claim we routinely pay off $5,000 to make it go away we may think we are making an eightfold saving.

The problem is that by not making a stand we may eventually have to sign a thousand $5,000 checks and are suddenly millions down. Small amounts soon add up when their frequency mushrooms.

Like the apocryphal frog in the slowly heating saucepan of water, we get incrementally boiled.

It is almost imperceptible a first but we slowly lose the skills and experience we need as we stretch out in our warming bath. Our claims departments eventually become institutionally risk averse.

Suddenly it is too late and we pass out.

All at once our poached and bloated carcass is floating face-down in a frog soup.

It is only when we start to lose serious money that we realise that we need to change our behaviour.

And is what we are doing morally right?

If we stay too accomadative the righteous get a double whammy. They pay a claims surcharge to subsidise illegitimate settlements on the way down a soft market.

And then when the market’s back eventually breaks, run-offs and insolvencies mean that some end up taking haircuts on legitimate claims on the way back up the pricing cycle.

The plaintiff bar just moves on to the next feed.

Where did all this come from?

The above is the remarkably frank reading of the market from an authentic free spirit I was lucky enough to meet earlier in the week. He is Rick Lindsey, CEO of US E&S player Prime Insurance.

Check out the remarkably candid podcast I recorded with him earlier in the week.

In a market bearing increasing stress, his business posted a 2018 combined ratio below 80 percent.

The secret? For one he “doesn’t compete with stupid” and he “doesn’t insure stupid”.

And the rest is a laser-like focus on paying legitimate claims and a vigorous defence of those that have little basis in the facts.

The hard part is bringing the customer along. Rick admits that if an insured wants him to settle a frivolous suit, there is very little he can do about it. He tries to talk them round but pays out if that is what they really want.

But he does his best to find clients that want him to do the right thing and defend when the facts demand it.

It’s a tough sell. We are conditioned to take the path of least resistance.

But why shouldn’t the right people win for a change?

In today’s insurance firms, underwriters have been forcibly separated from the handling of their own claims.

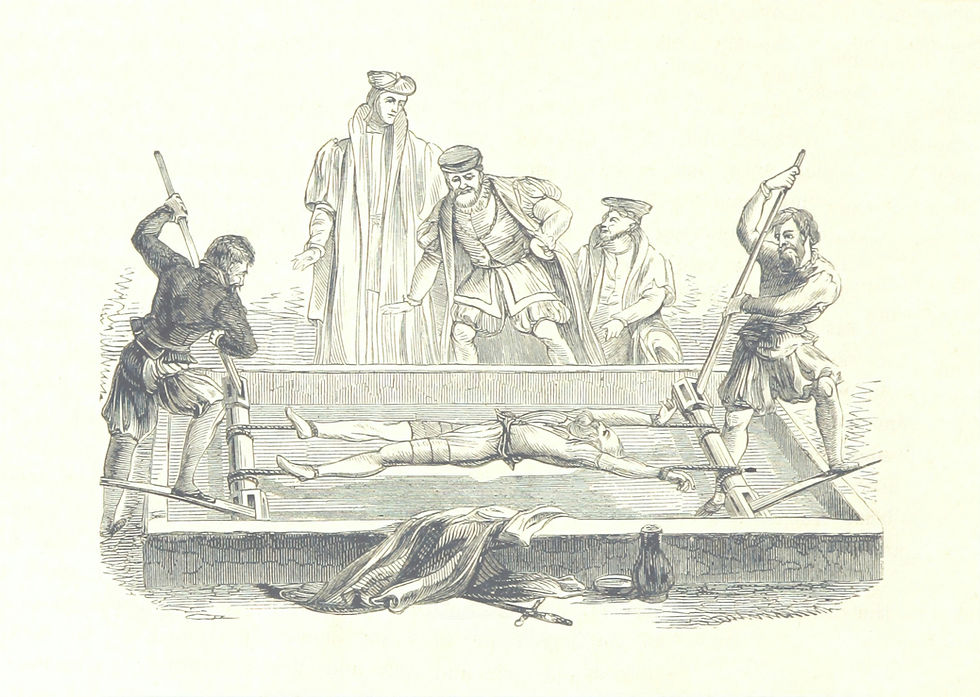

You can argue that there are very good governance reasons for this to happen. Visions of

conflicted claims-denying underwriters trying to save their bonuses may be filling your mind.

But Rick would argue that the strength of the plaintiff bar is the best protection against this. Any poor treatment of insureds would be punished tenfold in the bad faith tribunals (and rightly so).

So do take a minute to listen to Mr Lindsey.

You may not agree with all he says but I guarantee you will be refreshed to hear such uncommon plain speaking from a senior insurance executive.

Comments