What makes a good Lead Underwriter?

- Mark Geoghegan

- Dec 13, 2019

- 4 min read

Updated: Dec 20, 2019

What Lloyd’s probably needs is a resident philosopher.

No, seriously.

I know that might not sound like a good way of spending part of the £300m it has just raised to get Blueprint One done, but it might actually make sense.

The Lloyd’s Blueprint One reforms have thrown up some interesting philosophical questions.

The one I find the most fascinating is the quest to define what makes a good lead underwriter.

The Lead/Follow changes require Lloyd’s and the LMA to distil and refine the tangible attributes that managing agents will have to demonstrate if they are to be allowed to lead a class of business in any given underwriting year.

You can get all the detail here straight from the prime source – Sheila Cameron, the CEO of the Lloyd’s Market Association (LMA). I interviewed her at the beginning of the month and turned it into the first Voice of Insurance podcast

The changes are a great idea and are fundamentally tied into the whole vision that this first Blueprint espouses: Streamlining operations, empowering the best, bringing efficiency and productivity and creating a wider market environment where creativity and innovation can be attracted, nurtured and then scaled.

The LMA’s main role in this part of the process is to help Lloyd’s define what it is that marks out an underwriter as a good lead underwriter.

But this is really not easy. Even things that should be relatively simple to measure are more complicated than they first appear.

Take the numbers. It is reasonable to stipulate that our prospective leader ought to be the proud owner of an unbroken three-year profitable track record.

Numbers are supposed to be unambiguous.

But we all know that insurance numbers are anything but. They are slippery and amorphous and can baffle the finest minds. How many three-year winning streaks have reversed three years later as fragile IBNR assumptions are burst by a sharp new reality?

Then there is the ability to handle claims well on behalf of others. An underwriter without a recognisable and seasoned claims department is not going to be a prime candidate for a lead market role. Fair enough.

But while the numbers of claims staff and their collective years of experience are perfectly measurable, any judgment of their quality is once again intangible and subjective.

This is already getting a little more complicated than we first thought.

In order to measure the quality of a lead underwriter it seems we already have to asses the quality of the lead underwriter’s actuarial judgment and also the claims team.

It’s like a Russian doll set. Every time you open it up there is something else inside.

It may seem we are already in the realms of the metaphysical, but we are only just getting warmed up.

Now for the main event – the actual qualities of a lead underwriter. Are they logical or are they more psycho-logical?

Let’s start with a question that is as old as the hills:

How much of underwriting is science and how much is art? And how is this balance changing as more data and analytics come on stream?

Such a vexing conundrum will have occupied many a Lime Street ponderer over the last three centuries, with little chance of resolution.

Here’s another: How much does skill really matter? One presumes that good technical knowledge and understanding of risk is a given.

But what about plain hard work? Surely that counts for quite a bit too? One presumes lead underwriters mustn’t be lazy, but if they are the best, how hard do they really have to work?

And what of simple charm, charisma, the ability to nurture of relationships and the gift of persuasion?

What about the uncanny ability to do the sorts of deals that make both client and pricing actuary simultaneously happy?

What about consistency? Surely one of the best attributes of an underwriter is a reliability of appetite?

When a good broker has time and choice, they usually select to visit an underwriter who they know with a reasonably high degree of certainty will like what they are being offered.

It is no good an underwriter sometimes liking something and on other days professing to hate something else that is almost identical.

But then reliability surely clashes with the final attribute that most say they have to see in a top underwriter – creativity and innovation.

How can you be predictable and break the mould at the same time?

This Russian doll set is packed with contradictory figurines.

One presumes the ideal leader possesses all of these characteristics and more. Does such a creature exist?

And now to the science. How can these mythical attributes be measured and monitored?

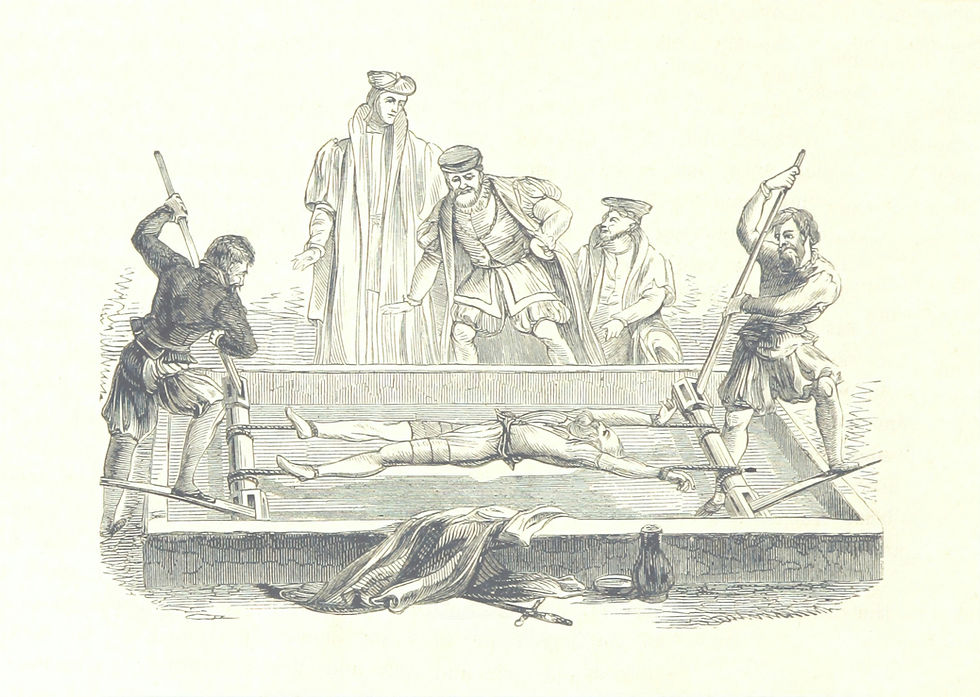

Should Lloyd’s send for the embalmed brain of Cuthbert Heath, grind it up into a magic powder and force new entrants to imbibe from it as part of an initiation ceremony?

Most would agree it should identify the underwriters who have garnered almost universal and unequivocal acclaim as leaders in their respective fields and really break them down, scientifically, numerically and psychologically.

Then it should codify their qualities as the yardstick by which all wannabe leaders shall be measured

But there’s one more complication. We’ve forgotten something very important.

There is another set of dolls inside this one.

We must remember that the Lead/Follow reform is setting out to measure the ability of organisations to be lead underwriters.

But it is always individual people that brokers and clients think of when they are looking to price and lead their risks and whenever we talk about lead underwriters we immediately start personalising their characteristics based on the people we know and admire.

It is not just the individuals but it is also the way that those individuals fit together that is important. In a lead team not everyone can be team leader. Indeed in a lead team sometimes the leading underwriter probably isn’t the best team leader.

So, what makes a lead underwriting team?

The more we look, the more we may discover that top teams have group dynamics, interactions, hierarchies, ways of communicating and cultures that set them apart.

If we are to succeed we will need to distil and bottle these essences too.

At the top when I told you Lloyd’s will probably need the services a philosopher you didn’t believe me. Now what do you think?

It will surely need an army of psychologists, behavioural economists, change management coaches and more.

It is clearer than ever that if nearly all of the market’s £300m goes on technology and kit without a very substantial portion being reserved for unconventional brain power, the reforms will never achieve anything like their potential.

Comments