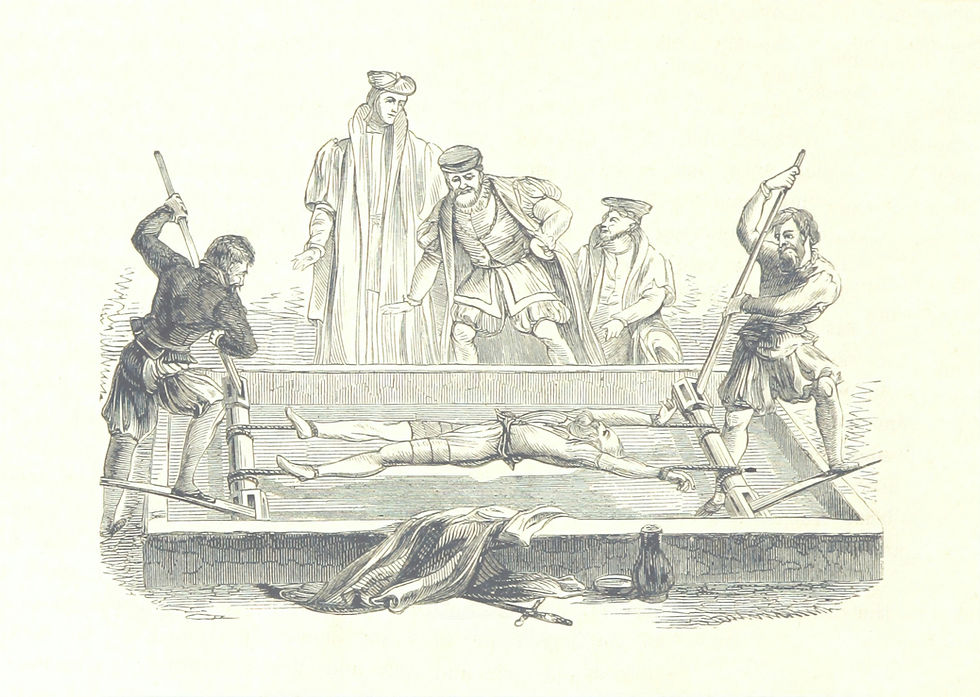

The Naked Coronation

- Mark Geoghegan

- Jun 24, 2021

- 6 min read

The Emperor was understandably a little nervous. He had been preparing for this moment for more than two years.

But finally everything was ready. The champagne was on ice and the feast had been laid out.

A vast crowd had been gathering in the capital all week and today it thronged outside the palace, necks craning to get a better view.

It was time for the coronation.

He would parade himself in front of the entire insurance world as its undisputed supreme leader, basking in the reflected admiration of his subjects as well as the envy of his diminished rivals.

A specially-composed fanfare played. As it ended an expectant hush descended.

The curtains to the imperial balcony opened.

The crowd audibly gasped.

Then an impertinent child shouted out: “He hasn’t got any clothes on!” and you know the rest of the moral tale…

Maybe this is how Greg Case is feeling after the US Department of Justice (DoJ) rained on his Aon-Willis parade earlier in the month?

Aon-Willis is predicated on very sound, utterly ruthless business logic. If you bash broker A with 29% margins into broker B with 20% margins and an almost 100% overlap of global operations you create a vast reserve of cost synergies, less competition and more pricing power.

After the bloodletting you emerge with something exceeding 29% margins across a much bigger top line and make a load of extra money as the undisputed world champ.

The trouble is that this is the same ruthless logic that makes private monopolies inevitable over time and is the reason why we have competition law.

When broker A is number one or two and broker B is number three in a three-horse race, you are going to be merging some pretty gargantuan market shares in lots of corners of the world.

Competition regulators can add up.

They can see that in a global market of three, having two of them join together probably isn’t a good idea.

But you thought of all this and allowed for divestments amounting around 20 percent of Willis’ revenues to cover it.

Never mind that this number had almost certainly been exceeded before the DoJ filed its suit, the prize was still worth it and you were going to bring it home.

You planned for everything down to the last detail. So what went wrong?

Two fatal errors have been committed that have exposed the nakedness of this emperor’s flesh for all to see.

I think they tipped the balance and forced otherwise benign authorities to act.

The first mistake was succumbing to hubris. Everyone can always see right through it – it is completely transparent.

The hubristic coup de grace in this deal was the idea that Aon and Willis simply had to merge so that they could innovate more.

This stretched credulity beyond breaking point.

With innovation coming in spades from a thousand micro-funded entrepreneurs in insurtechs all over the world, what exactly was stopping a profitable $30bn business or an even more profitable $50bn business from innovating?

A shortage of resources certainly couldn’t be it!

Or could it be that their unwieldy size, scale and lack of incentives to innovate were actually holding them back? If so getting even bigger wasn’t the way to solve the problem.

And how exactly would an $80bn business preoccupied with integrating and synergising itself be able to innovate better than a stable $50bn one?

No, innovation rang utterly hollow.

The second and most important mistake was to forget that insurance brokers are people businesses, not giant spreadsheets.

It is people that produce those 20-29% margins for you, they don’t produce themselves.

Exhibit A was the Aon Covid pay cut. I think it was a monumental morale-sapping disaster and a major red flag to regulators warning them about the likely culture of the merged organisation.

You have a global workforce working harder than ever to keep worried and financially distressed clients covered and informed, while itself suffering the personal trauma of the pandemic.

It is also scared about job security because of the merger you have just announced.

So what do you do?

Yes, give it a pay cut. Nothing says I want you to stay here like paying someone less.

Oh, but please maintain the dividend – we don’t want investors to think we have any fundamental problems!

Aon’s action was complete anathema to most broking CEOs – it simply wouldn’t have occurred to any of them as a rational course of action.

Later the firm limply reversed the whole thing, so everyone wondered why they bothered.

The other obvious mistake is another dagger into the heart of good employee relations. A major focus of Aon-Willis deal communications has been on synergies.

This may be what investors want to hear, but it is utter poison for staff. No-one wants to talk synergies when it is they who are being synergised.

When in May the Willis Re and other European units remedy sale to Gallagher was announced the message was very much “hey guys, we lost the reinsurance and some other bits, but, wait for it, the $800mn synergies are still intact!”

It was the second italicised line under the headline.

What are your current and future employees to think of your priorities when they read that?

The more numerate among them will also realise that it just means there will have to be proportionally even more brutal synergies than before.

Also, how are the colleagues meant to feel when briskly designated as “remedy assets” and sold on?

Fancy a job at Remedy Asset Re? I thought not!

The biggest mistake of all was to forget to sell the deal to their staff. What exactly was in it for them?

This has been a human resources cataclysm.

The most magnificent irony is that it is the DoJ that is being accused of fundamentally misunderstanding the business of insurance broking.

Look who’s talking!

Value is being destroyed as talent is sold or leaves of its own accord.

The Emperor has no clothes, save for an invisible cloak of hubris, which has long since fallen to the ground.

As he looks down at the bewildered crowd, what can be done?

Nothing.

The parade must go on. We have to go through with it. We will have our circus or there may be a riot.

The DoJ must be fought to the death. For another thing, if they didn’t fight, Haley and Case would come under immediate pressure to resign.

They bet the deal was doable as planned and it wasn’t.

They are the ultimate remedy assets.

But while resignations might cheer up some staff, they wouldn’t help remedy the situation.

In fact it would make it worse because it would just cause more uncertainty as succession was decided.

So we are stuck with them for now.

Other remedy assets must be sacrificed to the competition Gods and the synergies will become even harder to achieve from an even smaller, more disgruntled rump.

The double irony is that Aon and Willis have a strong case against the DoJ.

Surely no-one seriously thinks the US – the world’s biggest and most competitive commercial insurance market - will be underserved post Aon-Willis? MMC, Gallagher, Brown & Brown, Lockton, boutique start-up McGill and a host of others are ready to pick up any slack.

But fighting a major court case will take precious time. Reports suggest the DoJ is in no hurry. A trial may not be until February 2022!

This is almost certainly a tactic from the DoJ, but it is a very good one.

The meter is running and talent is continuing to drain away from both entities. Still more uncertainty and agony must be piled upon the most loyal and long-suffering staff.

This is a real mess.

Whatever the outcome, the damage done to both parties will take years to recover from.

After over a year (or nearly two) can Willis just pocket its break-up fee and pretend that nothing has happened?

Can Willis Re and the European remedy sales just kiss and make up with head office after what has happened?

It will certainly never get back the time that has been lost.

It was supposed be a coronation, a victory lap.

Now it’s a quick naked dash for cover.

Comments